- 158 Posts

- 9.98K Comments

4·10 hours ago

4·10 hours agoDeliberately formed a number of minority controlled governments, with a mandate to kill the majority ethnic group if they got out of line.

Israel was one of these, but hardly the only one.

1·10 hours ago

1·10 hours agoWho wants to own a 7 year old car?

I’ve got a Chevy Volt from 2018. Still runs great. Going to try and hang on to it for at least another couple of years.

I wouldn’t want to be paying a note on a seven year old car. My wife’s car has a three year note at 0.9% APY, and I can’t wait till that’s done with, even if the interest is nominal.

7·10 hours ago

7·10 hours agoThe main players in the Middle East have been fighting for the last 3,000

That’s wildly ahistorical.

What you’re describing is the Ottoman Empire, a region that was largely stable and peaceful for centuries.

9·10 hours ago

9·10 hours agoIn and out. Twenty minute quagmire.

You can just withdraw if things go bad, because it’s not like Iran will continue to bombard US and Israeli bases if we just shout “Time Out” loudly enough.

3·10 hours ago

3·10 hours agoSpeed running the Tet Offensive in weeks rather than years

10·10 hours ago

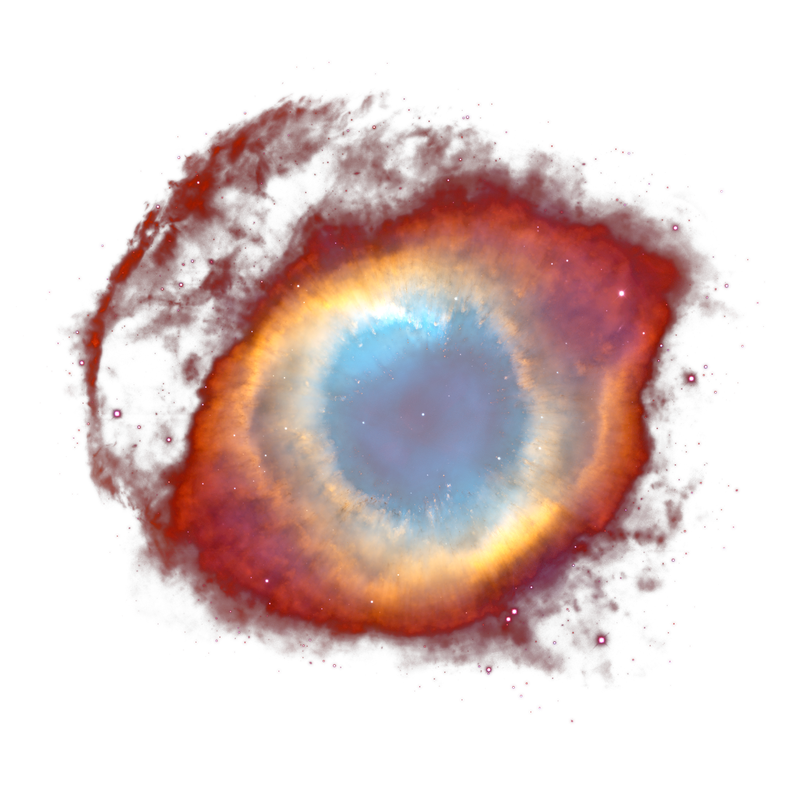

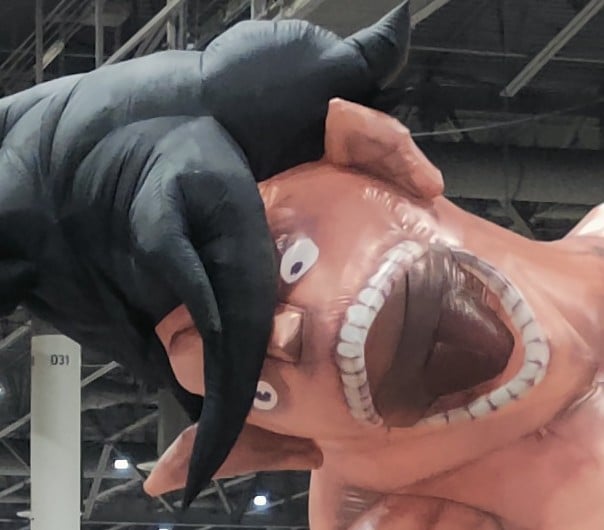

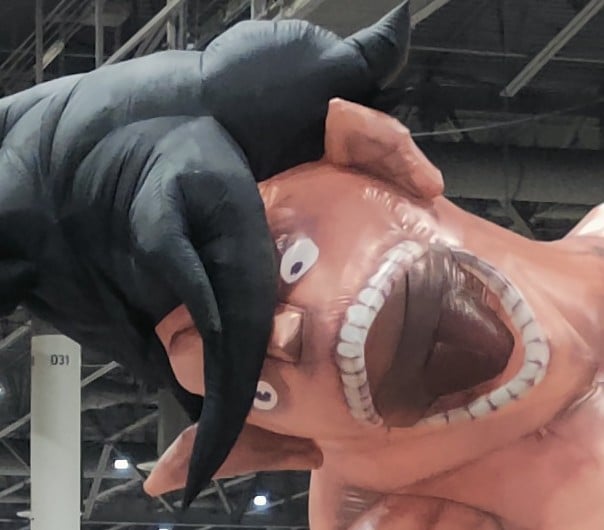

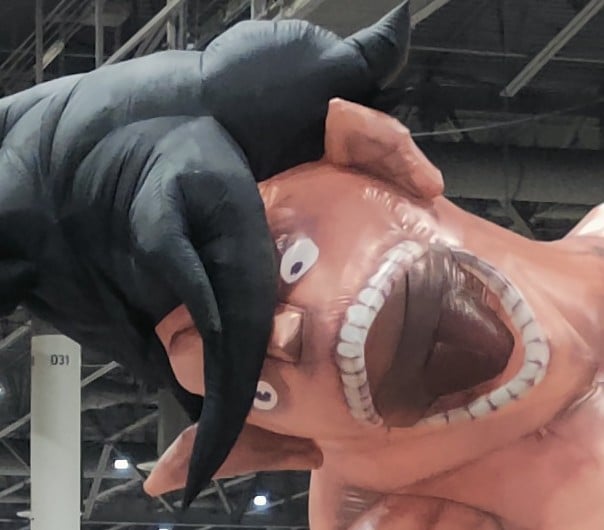

10·10 hours agoThese technically qualify as extraterrestrials

1·11 hours ago

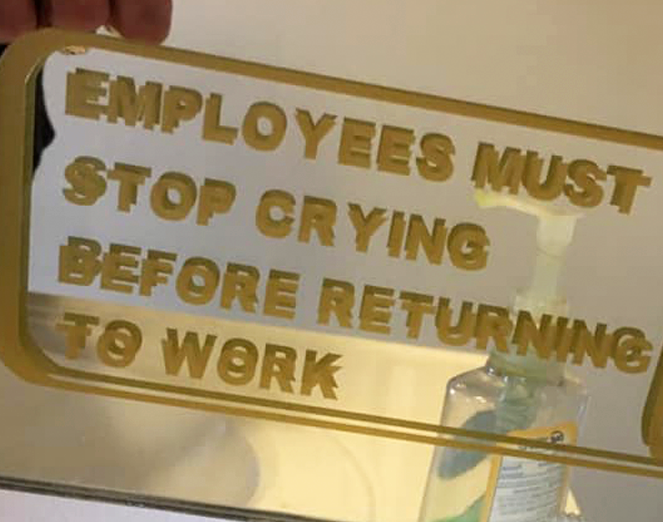

1·11 hours agoIt’s so simple even a Republican can use it

13·11 hours ago

13·11 hours agoI dont think you can blame everything Orban does on Americans

Sure. He’s got a huge network of domestic supporters who are along for the ride.

Every fellow American I know hates and mistrusts their government? To be fair, all of the people I spend energy associating with are strongly progressive.

Will you distrust the government when it flips back to Dem control?

Obama currently has a 90% approval among liberals. It doesn’t seem like they’ve learned anything.

induction roadways

Do you mean railways?

3·18 hours ago

3·18 hours agothey were within their rights to refuse to do business with the US government, and I don’t agree that the response to them refusing it should be the US government blacklist their company

I mean… you want to refuse business but you don’t want to be refused business?

How does that work?

121·18 hours ago

121·18 hours agoThey’re just trying to get clicks. It’s attention seeking behavior, not real concern for public policy.

FIRE has always been a corporate friendly libertarian-right organization. They post this stuff because they need to appear relevant to their sponsors.

4·20 hours ago

4·20 hours agoEh. Depending on where those parts were sourced…

It’s the rocket ship problem.

You need fuel to move the fuel that moves the fuel that moves the rocket

Less, now that we shut down the Straight of Hormuz

49·20 hours ago

49·20 hours agoOrban is a fucking FSB puppet

He came up through US anti-communist front groups and has turned his country out to Silicon Valley goons and evangelical reactionaries.

So had Putin, at least during the War on Terror era.

They’ve been peas in a pod under every Republican administration since Bush 41. At best, you could describe them as Rogue Assets, assuming you ignored how often they work to benefit American industry.

2·20 hours ago

2·20 hours agoHe started his career as a criminal defence barister, specialising in human rights. And he’s spent most of his political life reflecting back on that early tenure, insisting all his actions are informed by his desire for egalitarianism and social equity.

He’s the quintessential “we bombed your hospital because you hate the gays” neoliberal imperialist.

46·21 hours ago

46·21 hours agoTrump, Silicon Valley, and Europe’s Far-right

Heritage Foundation, a prime mover in American domestic politics: Why the U.S. Must Befriend Hungary’s Populist Leader

We’ve seen the American hand behind Orban since his days in the Alliance of Young Democrats (ironically enough, founded by Orban’s favorite whipping boy George Soros).

He’s an American proxy and always had been. If he’s been a wedge into the EU for decades, that’s by design.

Or it wasn’t. Very possible he was simply gifted the NFT and lied about the price.

A bunch of the early 20s NFT sales were wash sales

576·1 day ago

576·1 day agoOrban is a fucking russian asset

He’s more bound up in American geopolitics. But then Americans keep smelling shit, then blaming foreigners for the load in their pants.

It’s honestly kinda gross to see people blink past the bombing of schools, hospitals, and water treatment plants - the outright massacre of thousands of people - as though it’s a distraction from your domestic pedo politics.

Americans can’t even prosecute Woody Allen for this shit. It’s an absolute joke to think “Release The Epstein Files” is going to come to anything. Much less that it would preclude anyone from talking about the carpet bombing of Tehran.