Then let people decide for themselves.

The more you learn about history, the more you realize you don’t know. Very difficult to “just teach history” when you’re talking about an unfathomable number of people making an unfathomable number of decisions with unclear cause and effect.

What you learn in school is a very high level and narrow reading of events, largely informed by documents and transcriptions preserved by the wealthiest people in a region.

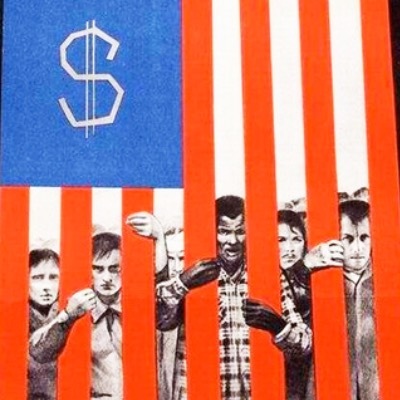

The only thing that can ever come out of that kind of historical study is nationalist jingoism of one flavor or another.

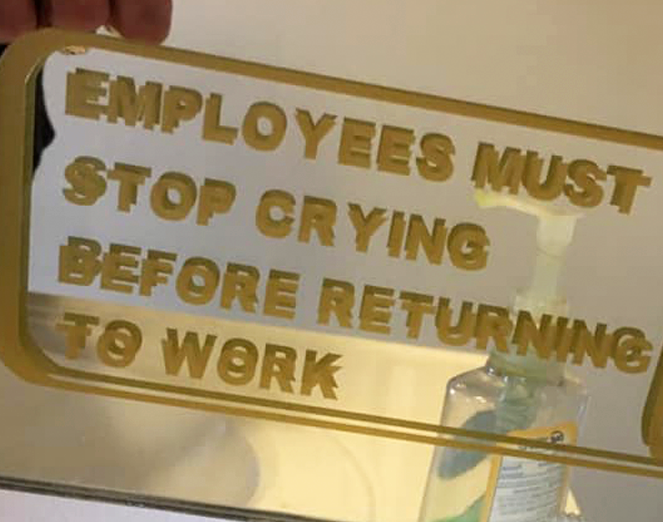

This dumbing people down and telling them what to think isn’t helping anyone at all.

The purpose of public education history classes is to craft a shared national identity.

Dumbing down events and telling people what to think is a simple and effective way of achieving that end.

Had a friend’s son tell me, very insistently, that Kim Jong Un convinced everyone in his county that he doesn’t poop. Also, that he’s planning to nuke South Korea, and we need to do something to stop him.

This was a kid with very liberal parents going to a very liberal middle school.

Red Scare shit is already everywhere. But I guess we’ve got to keep cranking the hysteria up to 11