On Elon Musk, it’s funny because he never put a profit, like tesla isn’t the biggest, X is draining money, his robotics shits are just that: shit, only spacex is relatively successfull, but it’s not on the same level of half trillion dollars.

There isn’t much that he’s done, all of his companies are making less profits (or losing more money if i’m being correct), he is just a jake paul that fakes being a fake intelligent person.

Edit: Deleted my edit, i’m drunk

Yeah, its ironic. The richest man in the world doesn’t have a single* truly profit-making venture under him.

How the bubble around him hasn’t burst yet I don’t know, but it would certainly be a feast for sore eyes.

*Edit: Forgot about SpaceX, which actually has made itself a decent chunk of money - about $15.5 billion in 2025 - but I doubt that alone is capable of propping up his nearly $500 billion personal valuation.

How the bubble around him hasn’t burst yet I don’t know

Corporate welfare.

SpaceX has been phenomenally successful. I don’t think he can be attributed to much of that success. The Falcon 9 handled 95% of launches in 2024. SpaceX has went from non existant to a near monopoly in 23 years while competing against some of the most powerfully connected companies in the world.

I’m not a SpaceX fanboy (I’m a space fanboy). They have done a lot of good for the space industry, while also causing a lot of harm to the scientific space community (earth based observations). I just don’t think you can make an argument that SpaceX is not a successful company.

I agree. Changed the text!

Not just earth based observations, they’ve pretty much guaranteed we’re have no hope in another space race versus China, or even just in general for the next decade at a minimum.

Go home drunk, I’m too Dad

deleted by creator

Apartheid-man’s basically a bubble unto himself.

only spacex is relatively successfull, but it’s not on the same level of half trillion dollars.

Not exactly sure what you’re trying to say here but spacex has tentative plans to ipo at a 1.5 trillion valuation.

Wallstreet is salivating over this because they know they get in first and will make bank when retail investor drive the price to ridiculous levels.

Yeah, but its profits (for 2025 at least) are <1/100th of that - so that valuation is bound to collapse very quickly…

And of course it’ll end up being the regular people who get screwed when that rug pulls.

I’m saying that it isn’t so profitable to make anywhere near that amount of money in decades.

I doubt spacex is profitable. The ipo is so they raise cash. They probably burned it all up with the starship failures.

I’m sure on paper it will look profitable same as Tesla looks profitable from certain angles but is actually propped up by the ability to create more shares. He’ll do the same with spacex. Bleed it for his own gains.

I don’t think he actually cares about any of this tech. It’s the only explanation for how he keeps wasting first mover advantage.

Gov gotta have their corporate frontman. Keeps their hands clean.

Just like his paypal buddy, spinning the golden wool of palantir from the unwelcome rot of total information awareness.

And now no pesky joe-public to get in the way, since it’s corporate, not public.

They’re clever like that.

Three bullets could do so much for this country

deleted by creator

Let’s keep ‘replacing’ them until the replacements end

But that would require more than 3 bullets

All I’m hearing is how great this would be for the bullet industry.

Could you imagine how many jobs it would create

deleted by creator

I’m okay with that.

We gotta start somewhere

deleted by creator

And they are so cheap!

The weird thing is that these people don’t think they’re rich enough and want to extract more money from government and the people, and they simultaneously think that the government gives too much money to poor people.

They race to who will be the first trillionaire. It’s disgusting. Meanwhile children are starving.

It’s bound to happen soon.

And you know what they say, the difference between a trillion and a billion is about a trillion.Surely someone’s already there, quietly, long time ago.

… Who owns the debt?

To these people, there’s no such thing as “enough”. Contentment is not a concept that exists within their minds, only a sociopathic urge to acquire more.

Imagine how rich we’d all be if all the suppressed emancipatory technologies got availed to each and all. No more impoverishment by rents. Free energy. Negligible cost of travel. All space opened to us each and all.

No more impoverishment by rents.

You’ve put your finger on it there.

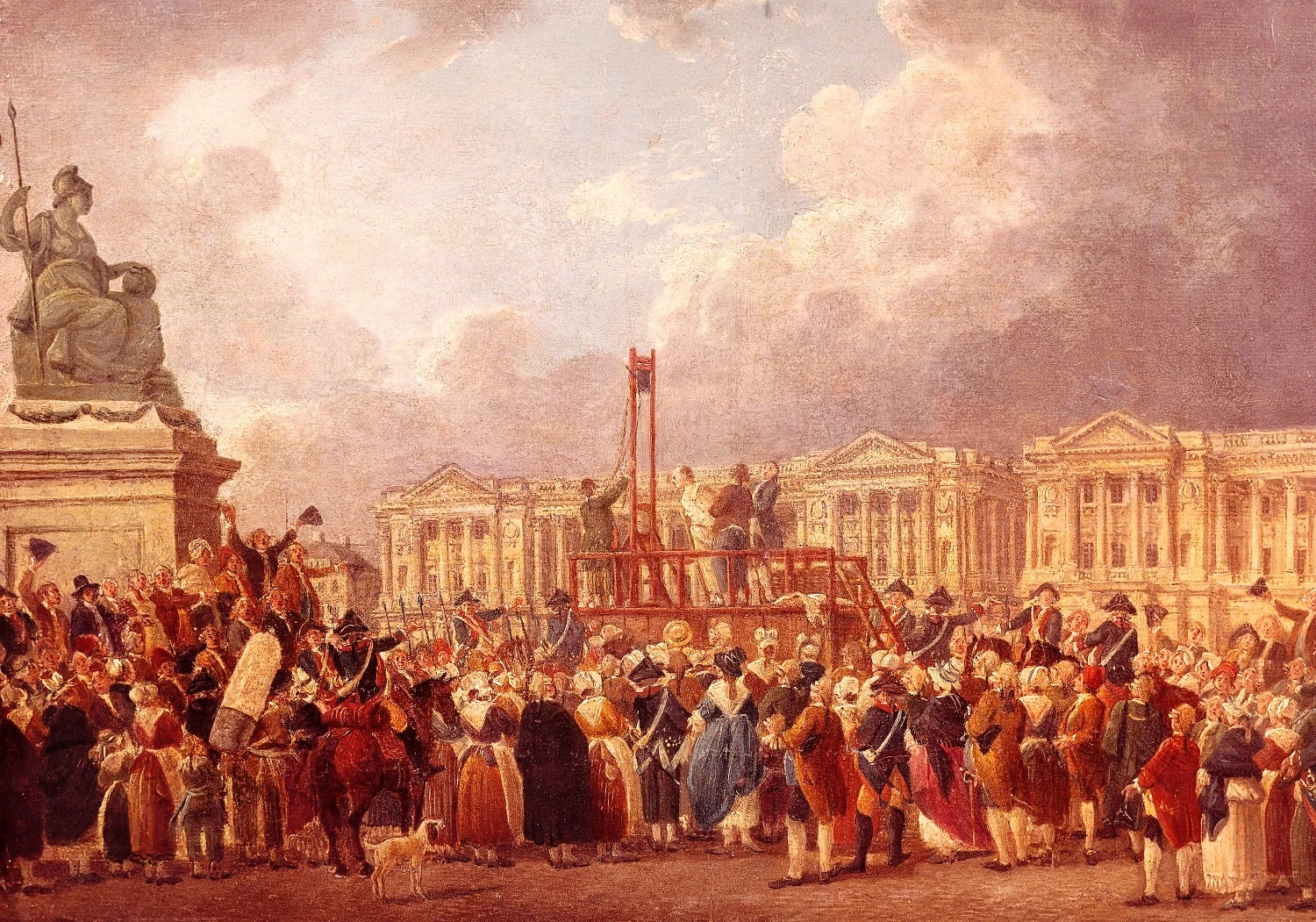

The french really did have a solid way of reminding the upper crust that they were vastly outnumbered by the people they were standing upon…

Remind me. Why are the worlds billionaires all building bunkers? A true mystery.

Honestly stop being poor dudes, just ask your father for some millions to get started and start exploiting people, easy

Just a small multi million dollar loan, Dad

Ask for several thousand dollars and go to a third world country where people only earn hundreds per year. Turn those thousands into millions. Easy.

Most Westerners can play Musk’s game in a third world country.

Any place that allows this to happen is a bad place.

Eat the rich.

People really should pay their bottoms more.

(sorry)

Damn, when I read this statistic the other day I took it as ‘the bottom half has less then the 3 richest persons’, but in fact, it is ‘three people each have more than the bottom half’ holy shit.

We already have Musk acting like his own personal country, making personal deals with world leaders that benefit only himself over other nations. Others are probably doing it, too, but we haven’t heard about it.

Now these Sociopathic Oligarchs are heading to trillionaire status, and they WILL be founding their own Corporo-Nations, which will require private armies for security. Eventually, these Corporo-Nations will combine to form their own alliance, combine their armies, and start throwing their weight around militarily, as well as economically.

This is all just a matter of time, and then we’re going to wonder as a planet, Why we didn’t stop those guys back when we had a chance?

I have no doubt at all that ALL of them have violated many laws, in many sectors, to get as rich as they are. Investigate them deeply, prosecute them for their crimes, and confiscate their entire fortunes. If we don’t do that, it is absolutely certain that we will come to regret it.

deleted by creator

Not shown: the innumerable corporate wars fought to create and expand these borders.

This is already happening guys, this IS going to be our medium-term future.

Alien only demonstrates the penultimate world government organization, before they each Psychopathic Oligarch decides they have to be sole King of the World, and they go to war genociding each other, with only one left standing.

Then it’s BuynLarge from Wall-E.

The age of kings returns.

As per, the only thing that trickles down is shit, vomit and piss.

Don’t forget that shithead larry Ellison. He’s worth 200b right now.

It’s hard to believe, but Ellison is worse than Musk. Musk is a lot like Trump, he wants love and respect, even though they are far too psychopathic to really understand what those things are, and they think that having money and acting tough will make people love and respect them.

Ellison doesn’t seem to care about that. He’s a mean, cruel person, who seems to enjoy being that way, and like Fred Trump, he raised his son to be as much a psychopath as he is.

Musk is dangerous, but he is too stupid and impulsive, and it blunts his impact. Ellison is far smarter, and far more effective. He’s not quite as rich as the rest, but at a certain level, who can really tell? It’s all just wretched excess after about $100 bill anyway. But even so, now that he owns CBS and Paramount, and is trying a poison pill takeover of Warner Discovery, he’ll be in the upper reaches very soon, jockeying for position at in the top rankings

And I doubt he will stop at CBS/ Paramount and Warner. Larry Ellison is going to control a massive amount of the media in the this country, and he is a massive MAGA, of the worst kind. There are supposed to be government controlled limits on media ownership, but all rules are elastic under MAGA, and he’ll be allowed to own anything he wants. Don’t be surprised if he ends up owning all broadcast TV, and then he controls the narrative for all political campaigns, election results, news programs, debates, etc. No candidate gets promoted on TV unless MAGA allows it.

So Larry Ellison is essentially Mr Potter from it’s wonderful Life

No, Mr. Potter was a sweet old man in comparison.

That’s fair I guess. Maybe the worst villain we could come up with back then is positively tamed by comparison today

Don’t forget the bankers who do not appear on such rich lists.

… How much did the Rothschilds have at the start of last century? Enough to own how many nations? Oh, maybe they just magically got poor since then, huh? XD

Every time I see these guys’ faces I cringe so hard. It’s frankly embarrassing working in the tech industry when most people think of them whenever anyone mentions it.

Now, I might be misreading this data, but from what it looks like either one of these billionaires by themselves have more wealth than the bottom 50% of Americans, right?

More like one Billionaire own 5.6 times the wealth of the bottom 50%

Yeah, this is phrased like those three just slightly edge out the bottom 50, as opposed to each individually owning significantly greater than the bottom 50. I’m going to assume these three own more than the “bottom” like 85%.

Top two are richer than the 3rd + the 50%

Cuckerburg